parker county tax assessment

Parker County Appraisal District. Estimate Your Home values for Free Connect with Top Local Real Estate Agents.

Financial Risk Assessment Template New Financial Risk Assessment Template Illwfo Schedule Template Guided Reading Lesson Plans Internal Audit

Banker for Parker County government working with departments and public for receiving and.

. The Parker County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed. Get Emergency Alerts from Parker County. TAX RATE INFORMATION.

How do I pay my property taxes. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Parker County Tax Appraisers office. The median property tax on a.

Courthouse Annex 1112 Santa Fe Dr Weatherford TX 76086-5855 Mailing Address. Jenny Gentry Physical Address. The Parker County Assessors Office located in Weatherford Texas determines the value of all taxable property in Parker County TX.

The Parker County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Parker County. The office of the county treasurer was established in the Texas constitution in 1846. The Parker County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Parker County.

Box 2740 Weatherford TX. Ad Current Assessed Value of Property. Parker County property owners protested.

Parker County collects on average 167 of a propertys assessed fair. Get Emergency Alerts from Parker County. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

Get driving directions to this office. View details on the following taxes. The median property tax in Parker County Texas is 2461 per year for a home worth the median value of 147100.

The total of all applicable governmental taxing-authorized entities rates. If you are already a resident contemplating it or only. The Parker County Property Appraiser is.

COVID-19 UPDATE PARKER COUNTY COVID-19 UPDATE Read On. Enter Your Zip Start Searching. Find information about taxes in the Town of Parker.

Please CHECK COUNTY OFFICE availability prior to planning travel. Create an Account - Increase your productivity customize your experience and. This applies only in the case of residential homestead and cannot exceed the lesser of the market value or the preceding years appraised value plus 10 plus the value of any improvements.

Explore how Parker County levies its real estate taxes with our thorough guide. They range from the county to Parker school district and different. Taxable property includes land and commercial.

817 596 0077 Phone 817 613 8092Fax The Parker County Tax Assessors Office is located in Weatherford Texas. This County Tax Office works in partnership with our Vehicle Titles and Registration Division. Get connected with Parker County reputable property tax consultants in a few clicks.

Parker County Tax Office. 1108 Santa Fe Dr Weatherford Texas 76086. Parker Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Parker Colorado.

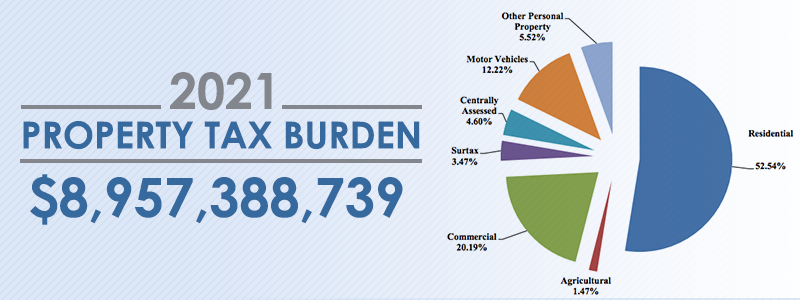

Parker County 2018 property taxes are estimated to total 2619 million based on an effective tax rate of 24 including homestead exemptions. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. 40 NE Interstate 410 Loop San Antonio TX 78216.

This figure is multiplied by the effective tax rate ie. Learn how county government.

Your 2020 Cook County Tax Bill Questions Answered Medium

Property Tax Calculation Boulder County

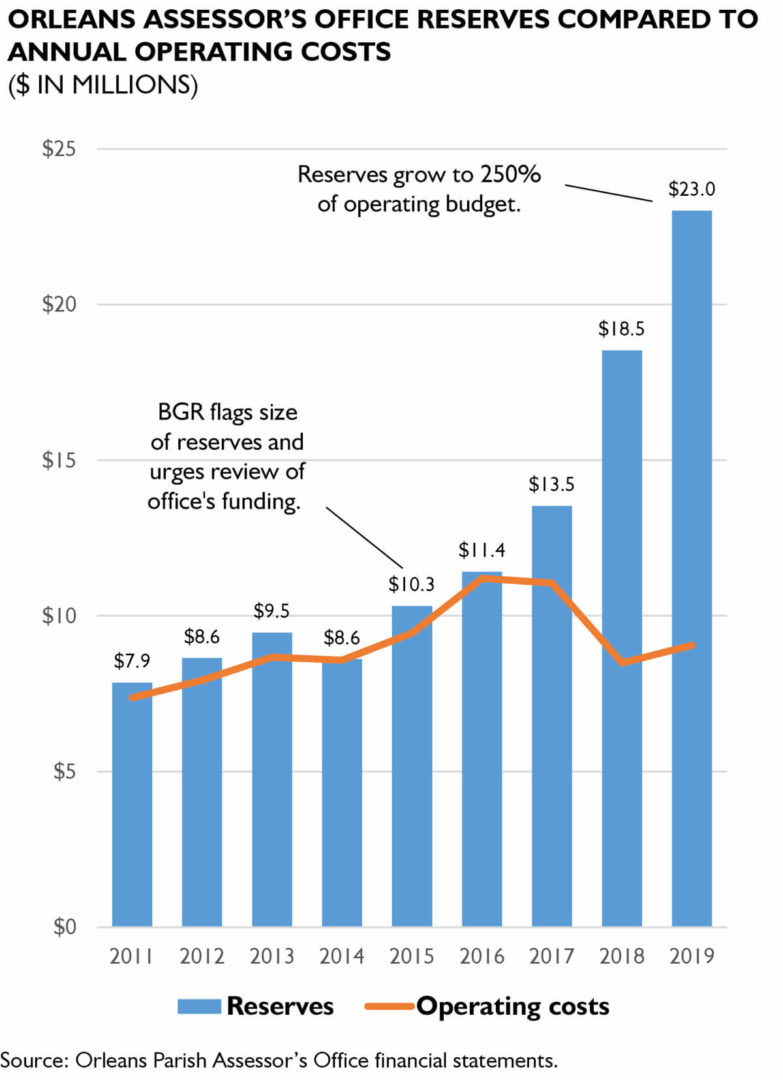

Policywatch Revisiting Assessment Issues In New Orleans

Get Best Tax Return Services At Affordable Prices Weaccountax Is A Leading Accountancy Firm For Financial Services In Income Tax Return Tax Return Income Tax

The Property Management Module Lets You Centrally Store Track And Maintain Information And Documentation F Property Management Management Facility Management

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

2012 Property Tax Assessments For Carroll Prairie Advocate

Law Amends Property Assessed Clean Energy Pace Programs In Virginia Jd Supra Assessment Renewable Energy Energy

Why Are Texas Property Taxes So High Home Tax Solutions

Policywatch Revisiting Assessment Issues In New Orleans

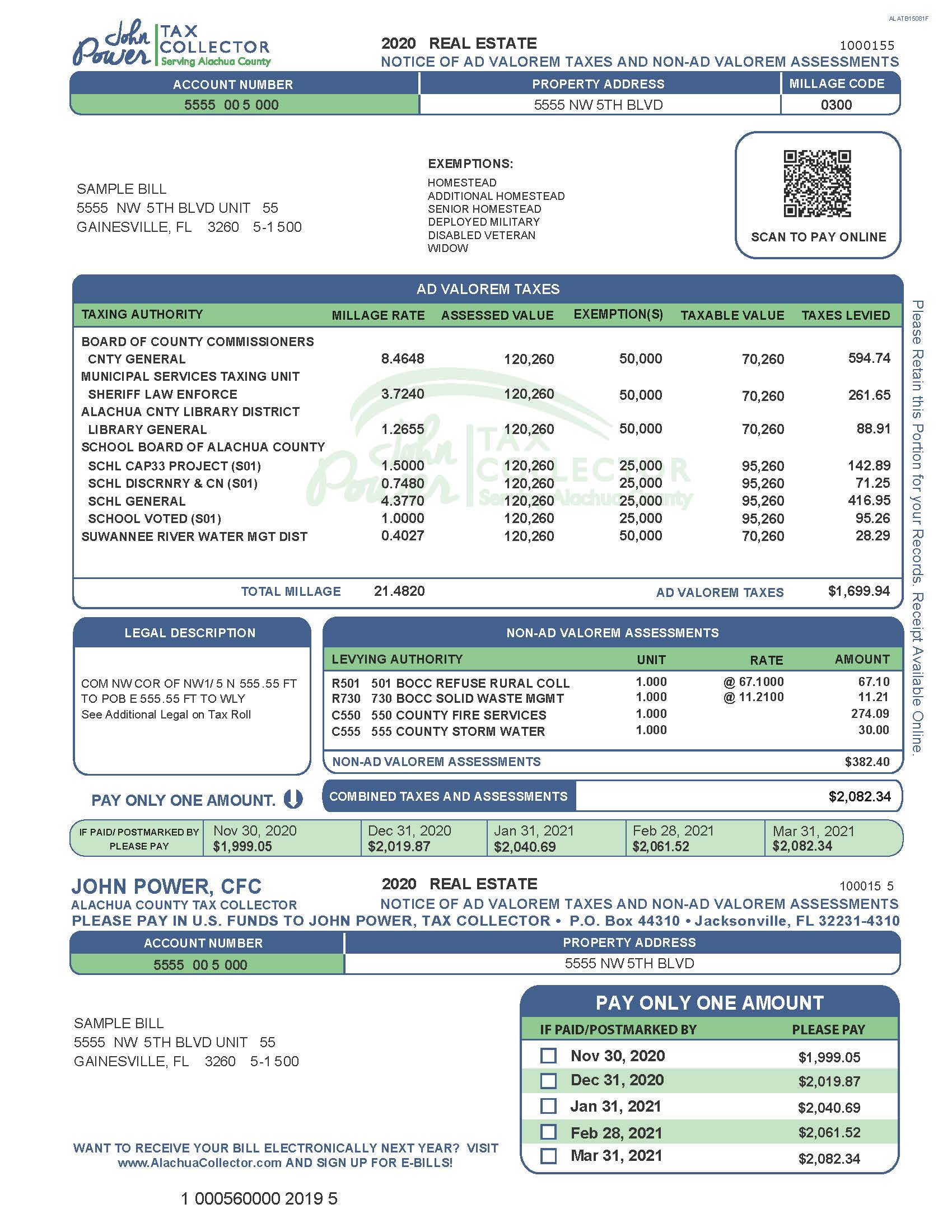

A Guide To Your Property Tax Bill Alachua County Tax Collector

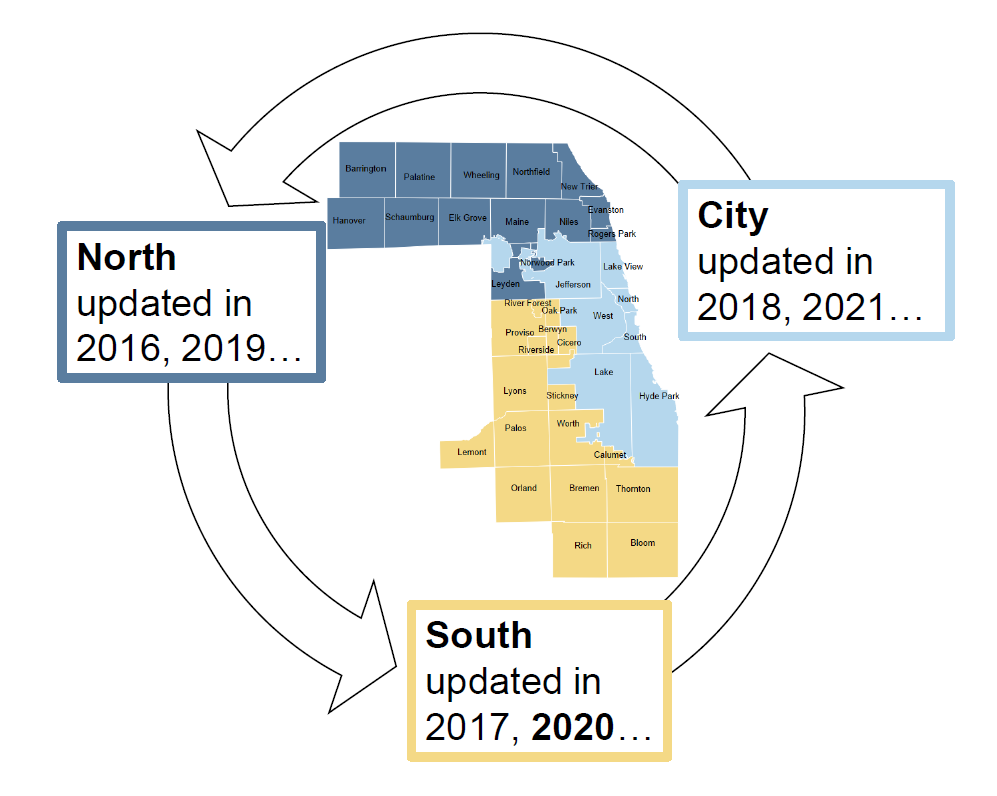

Your 2020 Cook County Tax Bill Questions Answered Medium

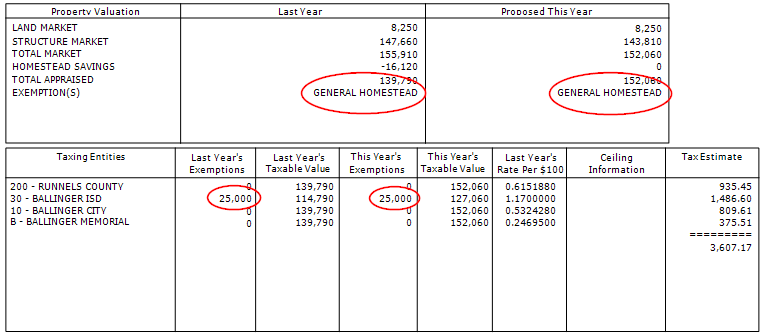

What Property Owners Need To Know About Homestead Savings Runnels Central Appraisal District Official Website